It is right to say that health is wealth. The changing lifestyle habits, population increase, and other factors can severely impact your health, leading to various health conditions. Medical costs associated with treating such diseases have increased rapidly. To safeguard your income against the high bills, you need to invest in a health insurance plan. They cover pre-hospitalization, hospitalization, and post-hospitalization charges. By assessing your financial position and the requirements, you can plan against medical emergencies through medical insurance. Luckily, if you need the best health insurance in the U.K, you can get a review of the best private insurance companies and their policies to help you choose the best one for you.

Below are the benefits of having health insurance:

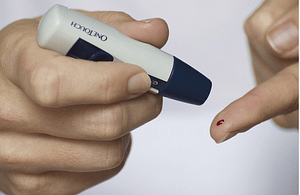

Helps to Manage Lifestyle Diseases

Lifestyle diseases are increasing rapidly in people below 45 years. Illnesses like diabetes, respiratory problems, obesity, and heart disease prevalent among the elderly, are rampant among the younger people. It is because of stress, sedentary lifestyle, pollution, poor eating habits, undisciplined lives, and gadget addiction. Taking precautions can help manage and combat the disease. However, an unfortunate incident might be challenging to cope with financially. Therefore, it makes it necessary to invest in a health plan.

Lifestyle diseases are increasing rapidly in people below 45 years. Illnesses like diabetes, respiratory problems, obesity, and heart disease prevalent among the elderly, are rampant among the younger people. It is because of stress, sedentary lifestyle, pollution, poor eating habits, undisciplined lives, and gadget addiction. Taking precautions can help manage and combat the disease. However, an unfortunate incident might be challenging to cope with financially. Therefore, it makes it necessary to invest in a health plan.

Provides Cumulative Bonus

When a claim is not filed by a policyholder every year, you receive an additional cover as a bonus. For example, medical insurance may not provide adequate cover in the first year but provides significant cumulative bonuses in subsequent years. Some insurance companies offer such bonuses as discounts in payable premiums, while others a combination of both.

Offers Cashless Claim Benefit

Most insurance offers a cashless claim facility. In this arrangement, you don’t need any out pocket payments. Hospitalization bills are settled between the hospital and your insurer. To get this benefit, you need to get admitted to the insurer’s network of hospitals. This arrangement can be beneficial during emergencies as it ensures the customer does not feel the impact of cash payments as a third-party administrator directly pays the hospital bill. It covers daycare procedures, hospitalization expenses, ambulance charges, and many others. Therefore, you focus on speedy recovery without worrying about high costs.

Most insurance offers a cashless claim facility. In this arrangement, you don’t need any out pocket payments. Hospitalization bills are settled between the hospital and your insurer. To get this benefit, you need to get admitted to the insurer’s network of hospitals. This arrangement can be beneficial during emergencies as it ensures the customer does not feel the impact of cash payments as a third-party administrator directly pays the hospital bill. It covers daycare procedures, hospitalization expenses, ambulance charges, and many others. Therefore, you focus on speedy recovery without worrying about high costs.

Protects Your Savings

Since unforeseen illnesses can lead to stress and mental anguish, the expenses can also leave you drained. When you purchase the right health insurance policy, you can manage the medical expenditure without withdrawing your savings. You can use your savings for other intended plans like buying a house, educating your family, and retirement. Additionally, with health insurance, you get tax benefits that further increase your savings.

an accident, theft, damage to your home or property or the death of a family member. No one ever wants these to happen, but they cannot be avoided. That is why you should consider getting an insurance policy. There are various types of policies available, and you can find out about them from an insurance outsourcing agent who will be happy to answer your questions.

an accident, theft, damage to your home or property or the death of a family member. No one ever wants these to happen, but they cannot be avoided. That is why you should consider getting an insurance policy. There are various types of policies available, and you can find out about them from an insurance outsourcing agent who will be happy to answer your questions. Every vehicle owner will require this insurance coverage if they want to drive on public roads. Most countries have it as part of their highway law, and you can be fined for driving without it. However, there are many benefits to this insurance than just following the law. In the case of an accident, you can claim damages caused to yourself, passengers, your car, and third parties. The benefits far outweigh the cost of the yearly premium that you will have to pay.

Every vehicle owner will require this insurance coverage if they want to drive on public roads. Most countries have it as part of their highway law, and you can be fined for driving without it. However, there are many benefits to this insurance than just following the law. In the case of an accident, you can claim damages caused to yourself, passengers, your car, and third parties. The benefits far outweigh the cost of the yearly premium that you will have to pay.

Make your home disaster proof

Make your home disaster proof